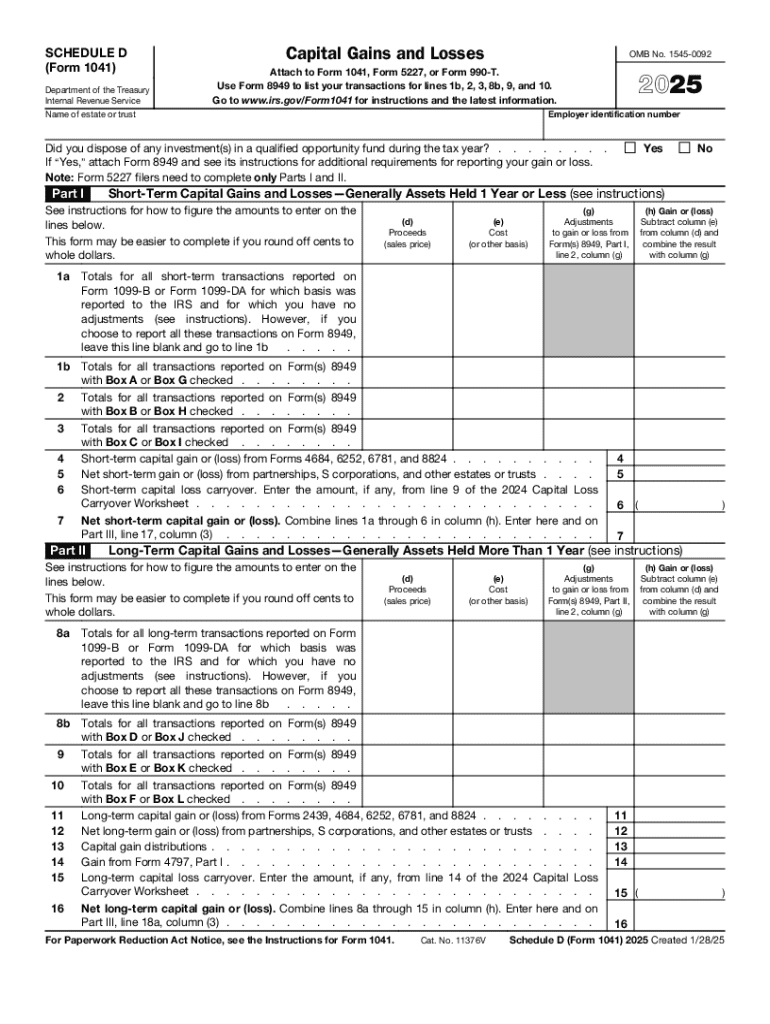

IRS 1041 - Schedule D 2025-2026 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

Latest updates to IRS 1041 - Schedule D

All You Need to Know About IRS 1041 - Schedule D

What is IRS 1041 - Schedule D?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1041 - Schedule D

What should I do if I made a mistake on my IRS 1041 - Schedule D?

If you discover an error on your IRS 1041 - Schedule D after submission, you can correct it by filing an amended return. Ensure that you refer to IRS guidelines for specific instructions on amendments, as corrections must be well-documented and properly justified. This process not only rectifies the information but helps avoid any potential penalties or issues with the IRS.

How can I verify the status of my filed IRS 1041 - Schedule D?

To verify the status of your filed IRS 1041 - Schedule D, you can use the IRS's online tools for tracking your return or contact the IRS directly. Make sure to have your details handy, such as your Social Security number and the filing status. This ensures you can get accurate information about whether your document is being processed or if there are issues that need addressing.

What should I do if my e-filed IRS 1041 - Schedule D is rejected?

If your e-filed IRS 1041 - Schedule D is rejected, carefully review the rejection codes provided by the IRS. These codes will help identify the issue; common reasons could include mismatched information or formatting errors. Once you address the identified problems, you can resubmit the form electronically.

Are there specific e-signature requirements for filing IRS 1041 - Schedule D?

When filing IRS 1041 - Schedule D electronically, the IRS accepts e-signatures if they meet certain guidelines. Ensure that your e-signature process complies with IRS standards to prevent any issues with your submission. This can include verifiable consent from all parties involved and secure documentation of the electronic filing.

What are some common errors to avoid when filing IRS 1041 - Schedule D?

Common errors when filing IRS 1041 - Schedule D include incorrect Social Security numbers, calculation mistakes, and failure to include all necessary documentation. Double-checking your input and utilizing available tax software or resources can significantly reduce the chances of these errors occurring, thereby ensuring a smoother filing experience.

See what our users say